In the previous article (Part 1), we revealed important information about digital-physical-digital (DPD) customer experience, which taught that businesses may like to categorize the customer experience into channels, however customers don’t see it that way. They expect consistency, no matter where or how they choose to interect.

We also gave you some tips to create a seamless DPD. In “PART 2”, I’ll keep revealing some other tips, so you can be sure to include all the necessary details when you create your customer journey.

3. Create a 'one-channel' approach so all your staff have the same information about every client

Although this is what customers will see, touch and experience, creating a seamless customer experience is not actually about the front end. It’s about getting your ducks in a row behind the scenes. And nothing annoys customers more than having to give you information that they already possess.

An example: banking in Australia

A friend of mine recently opened a new bank account in Australia. She was extremely impressed with their level of personalized customer service. While she was allocated an account manager, it was actually their digitally-savvy employee who is not quite a graduate yet who impressed her the most. When opening her business bank account this junior predicted that she’d need an additional account, and encouraged her to open it at the same time. Unfortunately, he didn’t know quite enough about why she would need this service (a separate account to set aside tax amounts that aren’t yet due…) to convince her to do it then and there, which would have saved a lot of time.

Instead, when she finally did decide to open the account her personal banker replied to her email, she went online to open the account, and was then sent an old-fashioned form that she had to personally complete, ‘wet-ink’ sign and post. Old-school, and not an ideal customer experience.

The lesson here is: the bank should be listening to their junior employee; whose goal was to make life as easy for his customer as possible.

So how can you make it easier for your employees to serve their customers?

Put the right data about that customer in front of your employees before they meet him or her. With the right technology you can even include details about their last interaction, current plans or status of contract or service and so much more.

Many organizations try to do this but don’t do it very well.

Excellent customer service about getting relevant customer information in front of the staff when it matters. A staff member is not realistically going to be looking at a chunky CRM when they’re talking to a customer. Data in a data warehouse is no good when a staff member is sitting eye-to-eye with a customer.

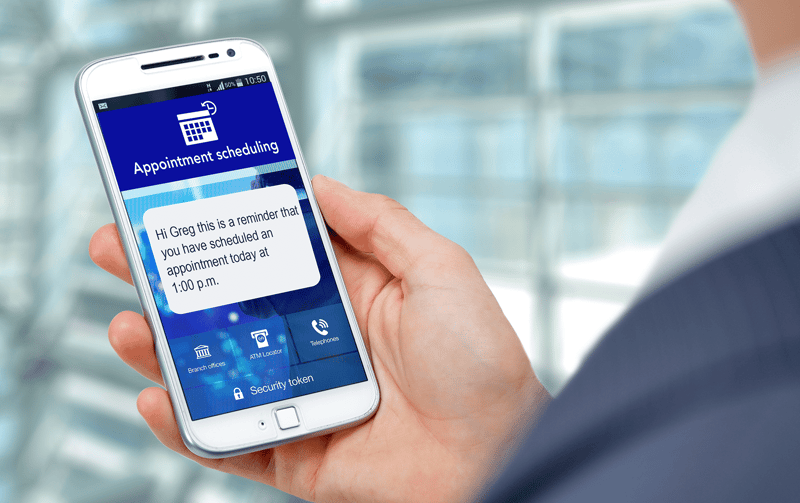

With the right appointment booking software: if you have a customer coming in, you know who they are, what products they have etc., you can prepare and read up on your notes about that person: what were their previous interactions, did they get their last issue resolved, where are they in their annual cycle of renewal for that product or service and so much more.

That way they get the most out of their appointment at the time and they leave the experience feeling amazing, like my friend did when she first interacted with the junior bank employee. (She felt so amazing, in fact, that she even wrote a poem about it and sent it to the bank employees – who loved it. Service can actually go both ways!)

4. Provide constant communications of the right kind

At ACF we also work a lot with medical organizations, where it’s even more important to reassure customers that they’re in good hands.

Keeping the customer/patient updated at all times allows them to feel in control at all times

Without communications, updates or reminders, customers can forget appointments. They need you to help them, prompt them and remind them that they have that appointment. They appreciate reminders. But don’t forget, communications can be used bi-directionally too. If you have a channel where a customer can ask a question, or maybe push back their appointment, that could make a massive difference to their lives, and to reducing your patient no-shows!

Not many organizations allow customers to re-schedule their appointments automatically, but imagine if they could…

Here’s how it works at ACF: we can get our Q-Flow technology to send a patient (or, indeed, any customer) an SMS to say, “The appointment is tomorrow, please remember to bring XYZ documentation”, as can many other companies. But what we can also do is enable the customer to reply, say, to ask if alternative documentation is okay instead. That conversation can happen in a real-time, bi-directional format. Then people form meaningful conversations either ahead of service, or afterwards. While many see this service as innovative, it’s actually not that complicated!

5. Make it easy for them to find you when they need to

Today it’s even possible to have your local banker on WhatsApp.

One of my friends was on the golf course with me. I asked him, “What are you up to?” while he was tapping away on his phone, thinking he was simply checking his email. As it turns out I was amazed to discover that, actually, he was messaging his bank agent to check on information, find out if payments have come in and so-on.

It doesn’t get simpler than that. As simple as a text message.

To me, it is fantastic that in the banking space, which has not been renowned for excellent customer service in the recent past, he gets a direct communication channel with a bank account manager via an app.

And that’s just one more way in which technology can create that seamless digital-physical-digital experience that todays’ customers are not just clamoring for, they’re starting to expect.

If you want to find out how technology can and should be used to create a seamless customer experience, get in touch. Our team can walk you through multiple successful omni-channel customer experiences that we have created for other organizations.